Product

Overview

Product

Overview

BALI

is an electronic banking application that facilitates

the online initiation of corporate and correspondent

banking transactions. With BALI, customers can now transfer

money anywhere in the world and from or to any bank

account in a secure and affordable way. In addition

to the Cash Management module, BALI offers transaction

initiation facilities for Trade Finance and Custodial

Services.

Today, banks are pressured

into offering comprehensive and complex financial

products at the most competitive prices. The recent

market collapse, deregulation and consolidation in

the banking sector, globalization and the pervasiveness

of the Internet, have joined to create a highly competitive

environment, where only well-positioned institutions

can survive. In addition to this, corporate customers

now need to source for the lowest price and leverage

quality of service, 24-hour accessibility and convenience

in order to survive in their own sectors. Turning

all these objectives into a tangible reality is no

small feat. Empowered with BALI, this is all within

reach.

BALI is one of the most comprehensive

Internet transactional banking packages today. It

enables the banks to meet the needs of even the most

demanding clients. BALI is a single platform through

which a panoply of other online value-added services

can be offered to customers. With BALI, accessibility,

convenience and quality of service are the key words.

Customers can access multiple products via one single

screen and easily initiate transactions, remit payments,

check their statements and reports online and even

ensure that proper authorization and administration

controls are in place.

Key Features

• Single window, single

sign-on capabilities to multiple financial products.

• Real-time transaction

initiation, routing and reporting capabilities with

online status updates.

• Custom-defined access

rights enabling product subscription concept and

multiple deployment model options.

• Powerful administration

and maintenance modules with flexible authorization

matrices that model real-life business practices.

• User Authentication

with dynamic passwords and digital signature technologies.

• Effective control

features, including audit trails, system security

and maintenance reports.

• Multiple devices

access (WAP technology).

• Multi-lingual, including

Arabic, Chinese and Japanese.

|

| BALI

Transaction Desktop

(Click to Enlarge) |

Benefits

Time-to-market deployments

with best-of-breed solutions.

Enables preservation of

existing IT Investments - BALI layers on top of

existing systems.

SWIFT compliant, integrated

business rule validations within the system, leveraging

in-depth understanding and knowledge of corporate

and correspondent banking.

User-friendly and interactive

with re-usable models, look-up features, drop-down

menus, input validation rules and a familiar Windows-based

client-server look and feel.

Smoother learning curve

for both users and administrators at bank and customer

sites.

Centralized administration

and system maintenance with minimum downtime.

Scalability & Flexibility

- BALI was designed to adapt to new and future business

and technological needs, enabling ROI protection.

Experienced team of ex-bankers,

developers and consultants from the banking sector.

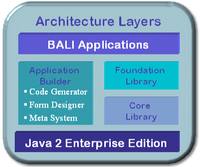

Technology

BALI is a pure Java and XML

breed, the current leading industry standards for

internet-based applications. We are one of the earliest

adopters of these technologies in our application

including:

Technology Specifications

• J2EE Specifications.

• EJB Architecture

Component.

• XML 1.0 System

Architecture.

The architecture of the

system consists of several layers, as we adopted

a framework approach in the development of the

system.

Security

The primordial

issue of security is addressed in our application

at 2 levels, network and application levels, to

ensure confidentiality, data integrity and non-repudiation.

Developed using J2EE standards, BALI inherits the

security features of the specification ensuring

that the application is accessed only by authorized

personnel. In addition, BALI provides additional

levels of security including:

• SSL

for the connection between the Browser and Web

Server.

• Advanced

contact-less (physical token) security feature

for authorization of transactions, including Digipass.

• Individual

product subscription feature to control user access

functionality.