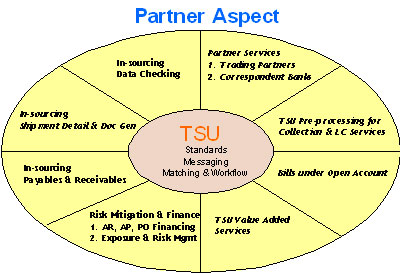

PARTNER ASPECT

Provides financial institutions

with full range of Open Account Services that offer

rich functionalities from procurement to payment.

It enables financial institutions help their customers

better integrate their financial supply chain.

-

Order Management

-

Order Management

- Advance Shipment Notice

- Invoice and Payment

- Compliance Checking

- Bank-to-Bank Reimbursements

- PO Financing

- Payable Financing

- Invoice Discounting

- Receivable Financing

Partner Aspect &

TSU – A Winning Strategy

•

TSU Inside – Being TSU-centric, Partner Aspect

brings TSU capabilities to your existing Open Account

Services

•

TSU Inside – Being TSU-centric, Partner Aspect

brings TSU capabilities to your existing Open Account

Services

• TSU Adapter

– Partner Aspect expands the bank’s presence in the

Open Accounts business by extending TSU facilities

to non-TSU correspondents and their customers

• SME friendly

– By minimizing efforts in system integration, Partner

Aspect liberates banks to pursue Open Accounts business

more aggressivel.

• Extend Reach

– Partner Aspect extends the bank’s reach beyond its

customers to their Trading Partners and their banks

·• Expand Offering

– Partner Aspect readily supports the inevitable

evolution and expansion of TSU in the Trade Value

Chain (e.g. to carries, insurance companies, ECGD,

FCIA, SGS, etc.)

Features

& Benefits

Partner

Aspect’s underlying framework fully endorses and adheres

to SWIFTNet TSU (Trade Service Utility) standards.

Partner

Aspect’s underlying framework fully endorses and adheres

to SWIFTNet TSU (Trade Service Utility) standards.

• Streamline the trade finance

processes that result in shorter order-to-cash cycle

• Brings financial supply chain closer to the physical

supply chain and provide transaction visibility

• Links the Trading Partners with their banks and

TSU – since TSU is strictly between banks (and does

not extend to trading partners)

• Offers Cost-effective Access to Service across the

Trade Value Chain

• Provides Common Platform for MNCs/SMEs for Open

Accounts/SCM

• Enables Bank to extend Open Accounts Services to

their Correspondents

Value Proposition