TRADE ASPECT

Implements full

functionality of conventional trade services for the

financial institutions

*

Documentary Letters of Credit

*

Documentary Letters of Credit

* Standby LC and Bank Guarantees

* Collections

* Shipping Guarantees

* Bank-to-Bank Reimbursements

* Bills Financing

Potential customers or customers

who have chosen our leading edge Partner Aspect may

wish to refresh their legacy trade services application

with Trade Aspect due to its superior Business Process

Management capability and state-of-art Service-Oriented

Architecture in order to increase productivity and

drive down operating cost.

Benefit

•

Expand Trade Service Market Leadership –

by offering complete Trade Services that includes

Open Account Service. Trade Aspect is seamlessly integrated

with Partner Aspect provides end-to-end trade solution.

•

Expand Trade Service Market Leadership –

by offering complete Trade Services that includes

Open Account Service. Trade Aspect is seamlessly integrated

with Partner Aspect provides end-to-end trade solution.

• Streamline Trade

Services Processes across different applications

is made easy with its process-oriented architecture.

“Business Process Personalization” is another powerful

feature where bank can offer different business processes

to different customers (or Partners) to meet their

needs.

• Lower Cost of Total

Ownership under several means:

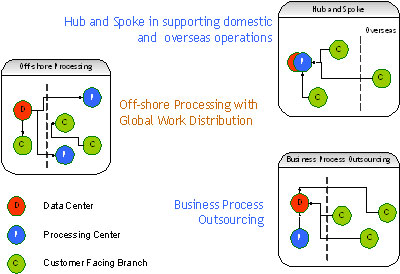

-New Global Business Models

offer Banks resource optimization that greatly lowers

the operating cost.

-Adoption of BPEL and Web Services technologies

to further reduce the cost of overall management,

modification, extension, and integration.

-Properly-layered SOA with the ability to plug in

country specific features to greatly reduce enhancement

and opportunity costs.

• Increase Revenue

by reaching new demographics – By helping

your customers to connect with their trading partners,

it brings revenue opportunity by new lead generation

as well as selling of cross-border services.

• Increase Business

Agility - establishes an environment which

responds to business requirements with unprecedented

agility and allows the business model itself to evolve

in more service-centric directions

Solution

Highlights

•

Service Request & Work Orders

•

Service Request & Work Orders

Branch initiates service request, authenticate scanned

document images.

Processing Center processes work order created from

service request

Separate process flow

• ASP model with BPO support

Site owner, legal entities, booking units locations

and sub locations.

White labeling with services entitlement

• Single system supports both

Front-End and Back-End processing

• Extends business process

management to bank’s customers

• Integration with TSU processing

• True Enterprise solution

that integrates with bank’s infrastructure services

such as Enterprise Content Management, Common Access

Control, and Business Process Management.

• Service request enable service

representative record the customer request and scanning

of attached document, authenticate the image scanned

before it can release to processing center for data

entry and further processing.

• Electronic folder provides

the easy path on the investigation process

• Enterprise Application Portal

enables bank to streamline business processes and

integrate user interfaces from different applications

under a single window.

• Powerful document engine

automates generation of all correspondence that include

SWIFT, Telex, Email and PDF document.

• Multi-cultural to cater to

regional needs